Why Fed Rate Cuts Don’t Guarantee Lower Mortgage Rates

- Sep 26, 2025

- 6 min read

The TL;DR: Mortgage rates don’t move in lockstep with Federal Reserve rate decisions. Instead, they’re driven mainly by the 10-year Treasury yield and mortgage-backed security (MBS) spreads. The Fed influences short-term rates directly, but its sway over long-term rates is limited and indirect — shaped by market expectations, inflation outlooks, and bond supply/demand. During crises, the Fed can intervene by buying Treasuries and MBS to stabilize markets, but in normal times, mortgage rates are determined far more by investor behavior than Fed policy. So, don’t assume a Fed cut automatically means a cheaper mortgage. The TL;DR for the TL;DR: It's more much more complicated than Fed rate cut equals lower mortgage rates.

Recently, I’ve received messages from friends saying they were pumped that the Fed was going to cut rates because they’ll finally be able to refinance their mortgage and save some money.

Boy, they had to be bummed in what’s transpired since Jerome Powell and the gang decided to cut rates by 0.25% on September 17th. Instead of falling, mortgage rates actually ticked up since the announcement was made.

So, what happened? Well, a common misconception is that whenever the Federal Reserve decides to raise or cut rates that means that mortgages rates will move in accordance to whatever decision gets made. But, that’s not always the case.

Here’s the rub. Mortgage rates are more tied to the 10-year Treasury rate (longer-term rates), than the federal funds rate (short-term rates). Unless the Federal Reserve directly intervenes in buying or selling 10-year treasuries as they’ve done recently whenever the economy falters, the Federal Reserve doesn’t have much direct control over longer-term rates. Don’t get me wrong, the Federal Reserve has some sway over long-term rates, but long-term rates are much more swayed by investor behavior.

A good example illustrating this was during the five years leading up to 2020. During that period, the Fed raised the federal funds rate from 0.25% to 1.75%. You’d expect mortgage rates to rise, right? Well, the average 30-year mortgage rate actually declined by 0.13%. Why? Because 10-year Treasury yields fell by 0.27% over the same period. So clearly mortgage rates followed Treasuries and not the Fed’s moves.

This becomes much more apparent when you observe how mortgage rates and treasuries moved nearly in lockstep during this period.

So since we can see that mortgage rates are much more driven by longer term rates, like the 10-year Treasury rate, and not the federal funds rate, this begs the question, “okay, so what influences long-term rates?”

What Influences Long-Term Rates?

Three things:

The expected future path of short-term rates.

The expected inflation rate over the maturity period.

The supply and demand dynamics for treasuries of that maturity.

Yes, the Federal Reserve has direct control over short-term rates, but it cannot know with certainty what the future path of those rates will be. The economy is far too complex and dynamic to forecast accurately. I mean, projecting what the economy will look like even a year from now is difficult, let alone what it will look like over the next ten years. This uncertainty makes it challenging for the Fed to model the long-term trajectory of its rate decisions, which depend heavily on the health of the economy at the time. As a result, the Fed has some influence on long-term rates through its stated expectations for future short-term rates, but that influence is limited.

The same goes for the expected inflation rate, short-term interest rates have some influence over inflation, but it’s hardly one-for-one, if the current inflation issues we’ve faced recently despite elevated short-term rates are any indicator. And again, because the future of the economy is so difficult to predict, the future path of short-term rates is uncertain. Combine that with the imperfect correlation between short-term rates and inflation, and it’s clear that the Fed has limited direct(1) impact on longer-term inflation expectations.

Next and as discussed earlier, the Federal Reserve has little direct bearing on the current supply/demand dynamics for long-term treasuries unless they intervene by directly buying and selling them via open market operations. They typically engage in massive treasury buying during times of economic turmoil, like during the Global Financial Crisis and the most recent Covid lockdown period. After they going on these buying sprees, they typically let these these holdings “run off” their balance sheet by simply holding them until they mature.

The Last Factor: Mortgage-Back Security (MBS) Spreads

So far, we’ve discussed how the Federal Reserve has limited direct influence over longer-term Treasury rates. But there’s one more factor that directly impacts mortgage rates and has no bearing on Treasuries: mortgage-backed security (MBS) spreads. A full deep dive into MBS spreads would warrant its own post, since it’s a much more complex topic. So for brevity, these spreads are largely determined by:

the perceived creditworthiness of homeowners (easy to understand) and

the supply and demand dynamics within the MBS market (much more complicated).

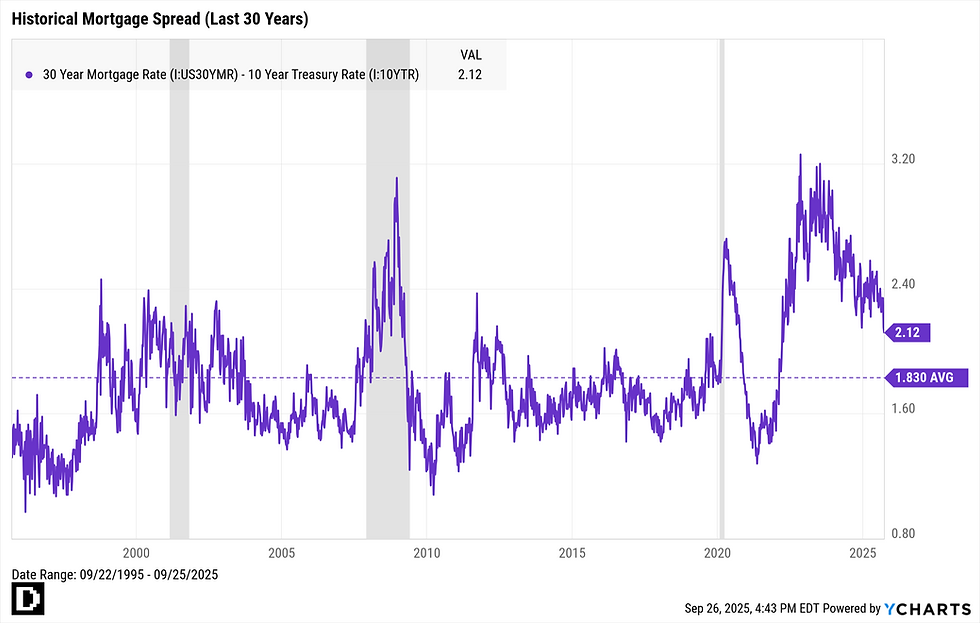

Using the spread between 30-year mortgage rates and 10-year treasuries as a proxy for MBS spreads, the spread typically oscillates around 1.60% during normal periods, but can widen to upward to a 2.50–3.25% range during times of economic stress or uncertainty. Since the residential real estate market is so crucial to the economy, during troubling times you’ll see the Fed buying MBS securities directly (like they do treasures) in order to support housing financing and provide liquidity, which puts downward pressure on spreads as a byproduct.

Bringing it All Home

The connection between short-term rates (where the Fed has strong control) and long-term rates (which drive mortgages) is moderately weak. Mortgage rates are driven more by market forces and investor expectations than by Fed rate decisions. This is why when the Federal Reserve cuts short-term rates, it has limited immediate impact on mortgage rates (if any at all, depending on the economic environment).

So if you’re banking on Fed rate cuts to open the door to a cheaper mortgage or a refinance, you’re likely to be disappointed. And I hope this goes without saying but, if you’re thinking of taking on a large mortgage that you can barely afford with hopes that Fed rate cuts will provide some future financial reprieve, please don’t. You’re going to get yourself into trouble.

Notes:

(1) The Federal Reserve has indirect influence over long-term interest rates through its mandate to fight inflation and the credibility investors give to its ability to do so. This commentary is prepared by and is the property of EID Capital, LLC and is circulated for informational and educational purposes only. There is no consideration given to the specific investment needs, objectives, or tolerances of any of the recipients. Additionally, EID Capital's actual investment positions may, and often will, vary from its conclusions discussed herein based on any number of factors, such as client investment restrictions, portfolio rebalancing and transactions costs, among others. Recipients should consult their own advisors, including tax advisors, before making any investment decision. This material is for informational and educational purposes only and is not an offer to sell or the solicitation of an offer to buy the securities or other instruments mentioned. This material does not constitute a personal recommendation or take into account the particular investment objectives, financial situations, or needs of individual investors which are necessary considerations before making any investment decision. Investors should consider whether any advice or recommendation in this research is suitable for their particular circumstances and, where appropriate, seek professional advice, including legal, tax, accounting, investment, or other advice.

The information provided herein is not intended to provide a sufficient basis on which to make an investment decision and investment decisions should not be based on simulated, hypothetical, or illustrative information that have inherent limitations. Unlike an actual performance record simulated or hypothetical results do not represent actual trading or the actual costs of management and may have under or overcompensated for the impact of certain market risk factors. EID Capital makes no representation that any account will or is likely to achieve returns similar to those shown. The price and value of the investments referred to in this research and the income therefrom may fluctuate. Every investment involves risk and in volatile or uncertain market conditions, significant variations in the value or return on that investment may occur. Past performance is not a guide to future performance, future returns are not guaranteed, and a complete loss of original capital may occur. Certain transactions, including those involving leverage, futures, options, and other derivatives, give rise to substantial risk and are not suitable for all investors. Fluctuations in exchange rates could have material adverse effects on the value or price of, or income derived from, certain investments.

EID Capital research utilizes data and information from public, private, and internal sources. While we consider information from external sources to be reliable, we do not assume responsibility for its accuracy.

This information is not directed at or intended for distribution to or use by any person or entity located in any jurisdiction where such distribution, publication, availability, or use would be contrary to applicable law or regulation, or which would subject EID Capital to any registration or licensing requirements within such jurisdiction. No part of this material may be (i) copied, photocopied, or duplicated in any form by any means or (ii) redistributed without the prior written consent of EID Capital, LLC.

The views expressed herein are solely those of EID Capital as of the date of this report and are subject to change without notice.

Comments